In this course, we learned various techniques that allow for efficient and reusable code. For my project, I selected analysis of the stock market using Cognitive Computing to recognize the presence of emotionally charged words that would lead weight to the performance of major players in the stock market. Through this I was able to ascribe earning or loss potential of a series of Stocks. The hypothesis being that the short term behavior of stocks is not governed by just analytical logic, but the impact of the news on the perception of gains or losses. Some analysts say the short term behavior of stock is governed by high unpredictable volatility , but Short Term behavior can be fueled by the sentiment the news creates which provides a level of noise reduction.

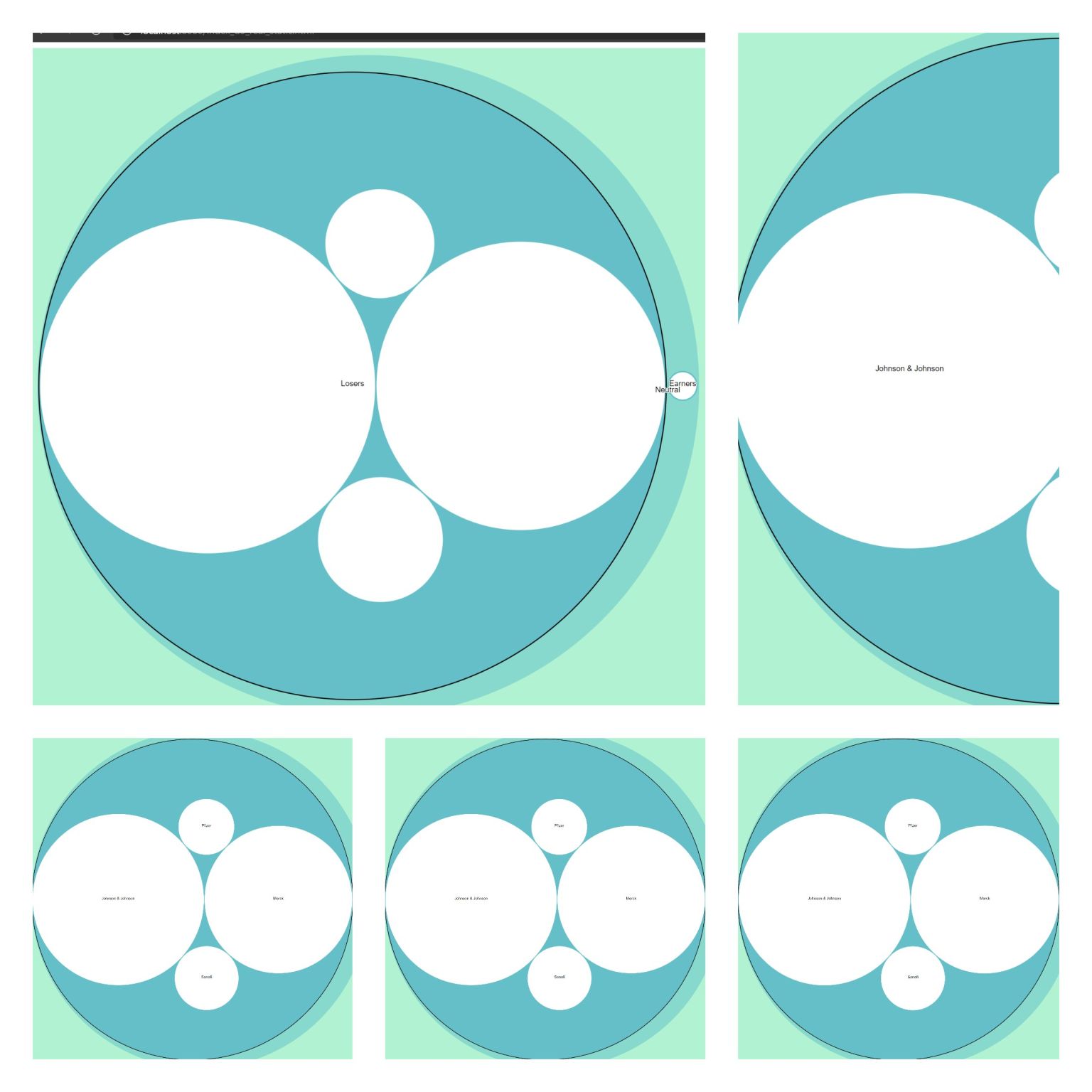

Above is a figure from the application that measures the performance of stocks and ascribes them bubbles based on the level of gains or losses.

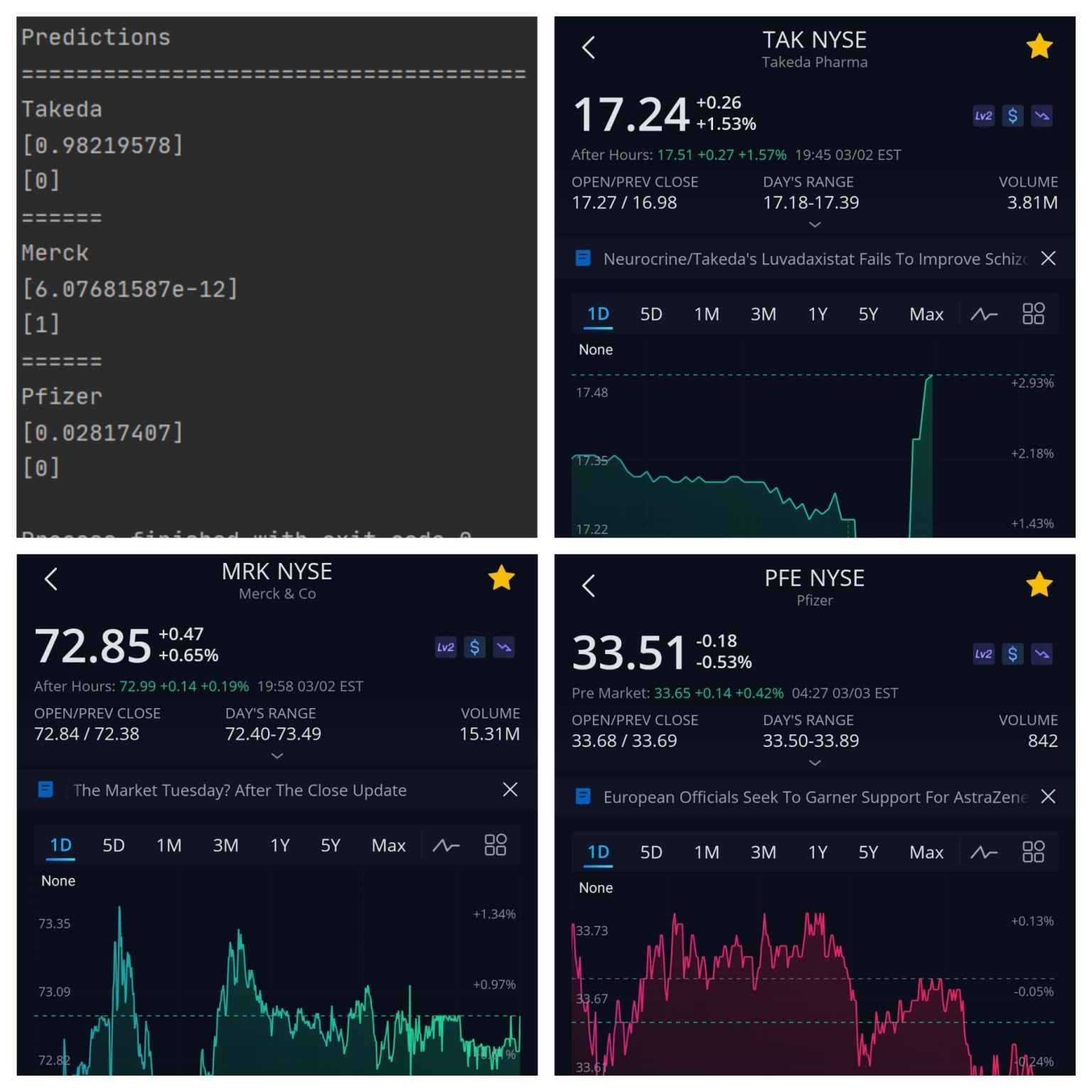

The above features a Neural Network that was trained on thousands of epochs to provide the logistical regression. The code did not use the traditional route of Python Pandas, SciPy, Scikit-learn, and NumPy. Which were later studied in MET CS 677.

This code is not publicly accessible, but might one day be available for use.